In his seminal work on how competitive forces shape strategy[1], Michael Porter stated that, “ the essence of strategy formulation is coping with competition”.

There are different forces that take precedence in defining competition with in each industry. In many of the retail segments buyers or consumers are the ones calling the shots. The automotive retail is slightly different in this regard. The products in the industry, essentially automobiles, are controlled by the same top brands over for over a quarter of the century. After the Japanese automakers made their foray into the US market in the 80’s there has been no major disruption till the last decade. Toyota and Honda were able to compete in the US market by offering superior quality vehicles at a reasonable price. Since then every automobile manufacturer has standardized on the individual manufacturing process and now there is no differentiation based on quality between the vehicles and automobiles has become a commodity.

As Porter points out, for a major disruption in any industry the prevailing conditions need to change. The deep recession of 2007/08 resulted in customers getting conscious of their household spending and cutting down on discretionary spending. The average commute time of American reached a record last year.

“The average American has added about two minutes to their one-way commute since 2009, the data shows. That may not sound like a lot, but those numbers add up: The typical commuter now spends 20 more minutes a week commuting than they did a decade ago. Over the course of a year, it works out to about 17 additional hours commuting.”

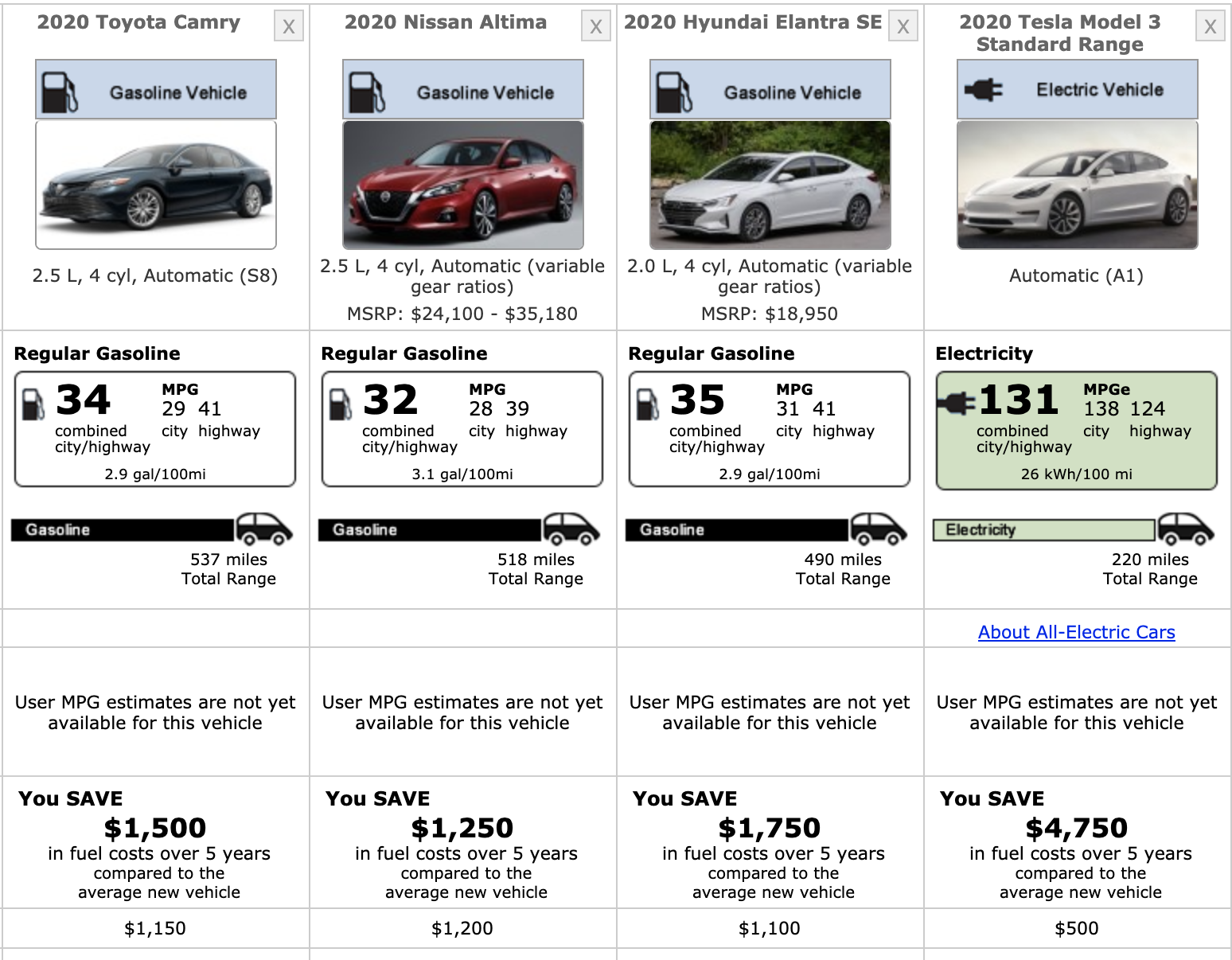

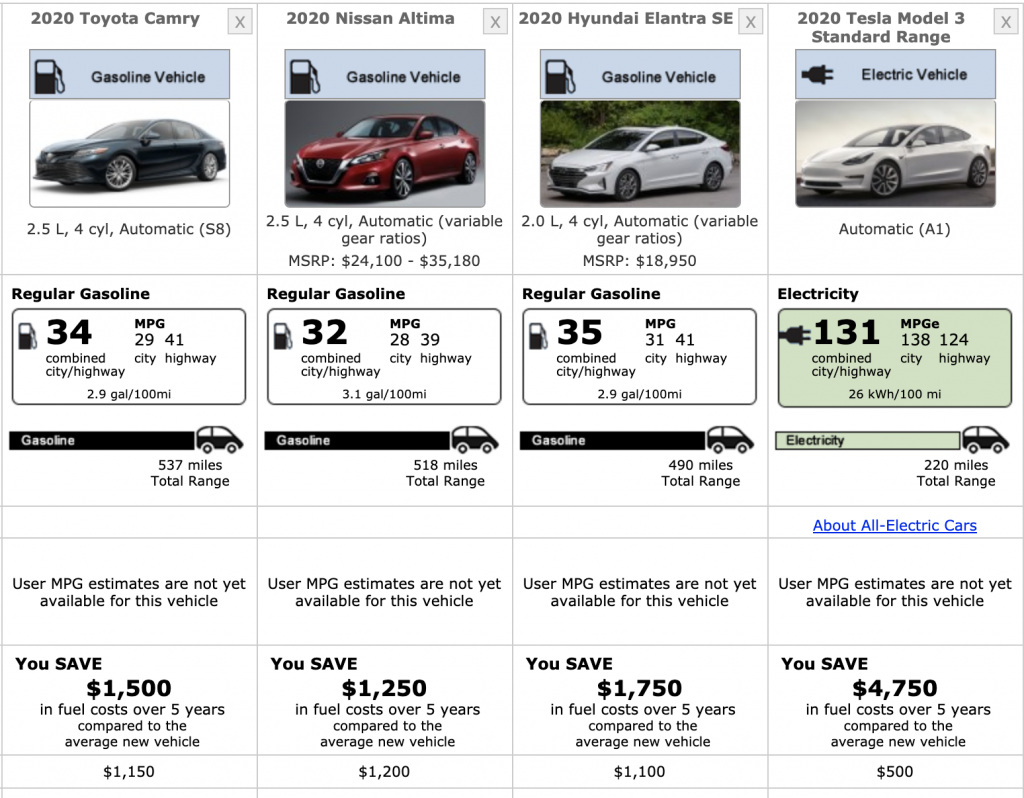

“For most people in the United States, the fully electric cars of today fit range needs by a long shot. The average person commutes well under 10 miles to work–even if that commute takes an average of 52 minutes a day.”. Miles per gallon is an important consideration when making a new car purchase.

Every industry has an underlying structure, or a set of fundamental economic and technical characteristics that gives rise to the competitive forces that determines the overall business profit. By catering to the environmentally conscious and educated customer as well as providing an “apple store” like experience, Tesla has changed the ball game between the automotive OEM’s. Along with the brand differentiation around stylish electric vehicles, Tesla has innovated on the distribution channel also. Tesla has clearly succeeded in harnessing “Threat of Substitution”.

All things being equal on the miles per gallon and quality side, and if you are not in the market to buy a Tesla, what else would be a determining factor in customer’s mind.

In automotive retail the dealership product pricing is the key force that determines the industry structure. This brings us to the most important of the 5 forces — Buyer Bargaining power. The information asymmetry between the average consumer and the salesperson has resulted in a disadvantage for the consumer and a lopsided buyer seller market.

Consumer’s quest to reduce this disadvantage often resulted in the process of haggling at the dealerships. The information gap has also contributed to creation of a billion dollar companies like True Car, which focused on providing as much information needed for the customer to make an informed purchase decision. Rather than haggling upfront with the sales person, the customer now pulls up the True Car price or invoice price and hopes the sales person can beat it. Because of the attention to negotiation and trying to get a better price the purchase experience takes a back seat during the vehicle purchase.

The trends around customer purchase patterns are important because it causes changes in the sources of competition and the positioning of the leading players in the market. “Established players would need to differentiate the product either substantively or psychologically through marketing, integrating forward or backward, establishing technological leadership”.

Lexus also identified these trends early in the market and piloted the “LexusPlus” program.With single point of contact and upfront pricing, the conversation was centered around the joy of purchase and ownership. Hyundai has created the “Shopper Assurance” program to provide their customers a seamless purchase experience. As Intensity of Rivalry increases we will be seeing more OEM programs aimed at differentiating on customer experience and brand promise.

What is a general solution for the market?

The idea is that the bargaining power of buyers in an industry affects the competitive environment for the seller and influences the seller’s ability to achieve profitability. Strong buyers can pressure sellers to lower prices, improve product quality, and offer more and better services. All of these things represent costs to the seller. A strong buyer can make an industry more competitive and decrease profit potential for the seller.

When one party in a sales transaction has more information than the other, the party with more information has the advantage and calls all the shots. This is where digital retailing can help solve the information gap. It helps the dealer address the needs of both strong buyers and weak buyers.

A buyer can do the vehicle research and get penny perfect payments based on their credit score. He/She can find out the value of the owned vehicle and see if it matches to the values provided by other valuation services like KBB. The customer can find out if a specific warranty product is needed and the cost savings from expensive repairs if something goes wrong with the vehicle.The fact that the consumer can do this at their comfort, with no sales people trying to rush the transaction, makes it an enjoyable purchase experience.

One of the more telling indicators is the closing ratio of the leads generated through digital retailing tool. There is a transformation in the sales process and changes the dynamics of the showroom visit.When the payments presented online is consistent at the showroom, it builds trust and remove the information asymmetry and make transactions more easy to complete.

As a dealership, are you ready to apply digital retailing as a tool in your competitive strategy ? Let us show you how.

https://tagrail.com/landing/#sectionRequestDemo

[1] https://hbr.org/1979/03/how-competitive-forces-shape-strategy