ooking at the digital retailing options, it is very easy to get lost in the cacophony of feature/benefit pitches from the different vendors in this space. There are some great DR products, but the main question is that how many of them can provide an end to end experience that satisfies both customers and dealerships while addressing the current sales process at the dealership.

In this post I will describe our process and how we try to get the ABCs of Digital Retailing right. We are featuring our new DR Theme (WE3*) during NADA 2019 and highlight a new feature called “Pre-Purchase Attribution” that increases the conversion likelihood of every lead coming through our platform.

*WE3 stands for Customers,Dealers and Us, the key pillars to making the DR experience seamless

One of the most common methods of attribution in the digital marketing industry is based on the last click, which means giving credit to the last channel that the user clicked on before “converting,” or making a purchase. The common theme that we keep hearing from our dealer community is that digital retailing in the current state is more of a lead generator and that they want to take control of closing the customers on their own. When DR functions as a lead generator, the attribution that comes along with it to make the sale happen will become a differentiating factor. This is the motivation behind us introducing the “Pre Purchase Attribution” feature to our platform.

It is a fair enough argument that most consumers are still long way from making the new car purchase/lease entirely online. They are providing many of the clues to their decision making process while interacting with the digital retailing tool. For eg: some of the questions we can easily answer are

- What is the best default monthly payment/downpayment/rate combination that we should yield the maximum conversion for a make/model?

- How are the OEM specific rebates swaying the customer decision to lease vs purchase?

- How much influence does the trade-in value have in moving the customer forward through the funnel?

- Is this customer price conscious vs value conscious ?

These are some relevant questions and there are more that our digital retailing tool can offer as it analyzes the shopper journey closely. We are providing these contextual insights along with the leads that we push into the CRM. There is no need for additional data mining on the dealership side and a quick look would enable a sales consultant to present the right quote for the customer.

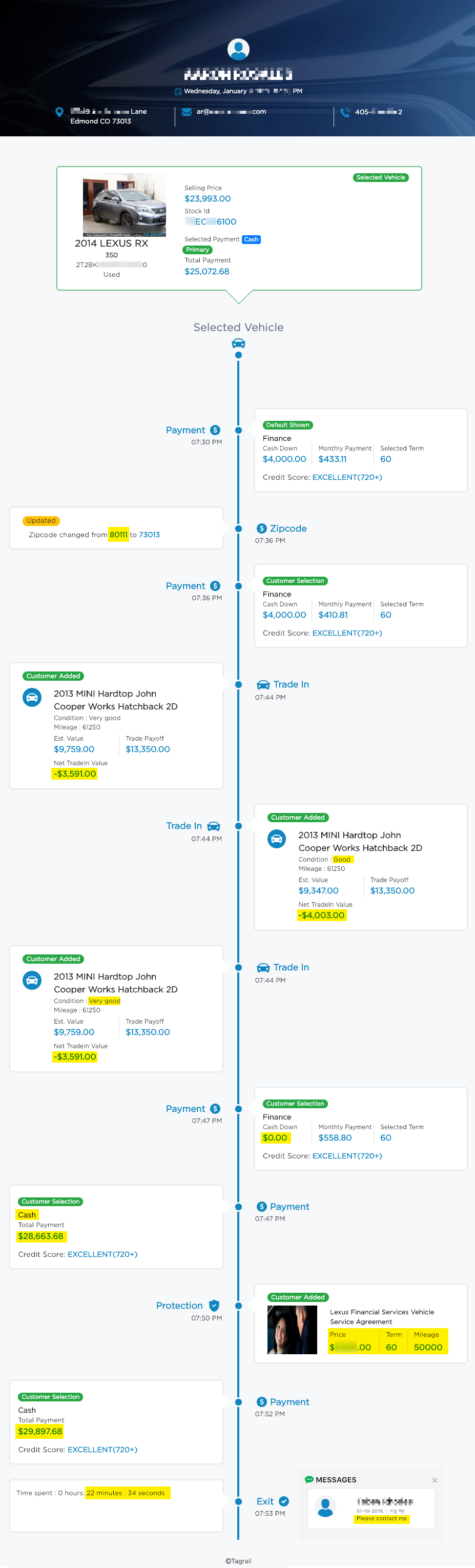

Let’s follow the clues left by an Online shopper on the path to purchasing a USED 2014 LEXUS RX 350 and how our system tracked it.

This journey starts when the customer clicked ‘Shop Online’, providing the PII to unlock the price and continues all the way he/she looked at different payment options.

Here is what happened in the journey (highlighted in yellow).

- The PII information is clearly shown for the opportunity.

- Sees a monthly payment with a $4000 downpayment.

- Changes the zip code to the correct area. Sees the change in payment.

- Enters a trade in vehicle, played around with different conditions for trade.

- Sees that the trade meets the $4000 downpayment he/she had in mind, so decides to use the trade instead of putting down a down payment.

- Decides to buy the new vehicle with full cash down with the trade added.

- Adds 4K worth of protection items to the vehicle ( very interesting to note that he/she is using the 4K trade to buy in new additions).

- Spends 23 minutes on the Digital retailing page and makes the final selections.

- Sends contact request to the dealership with the full deal information.

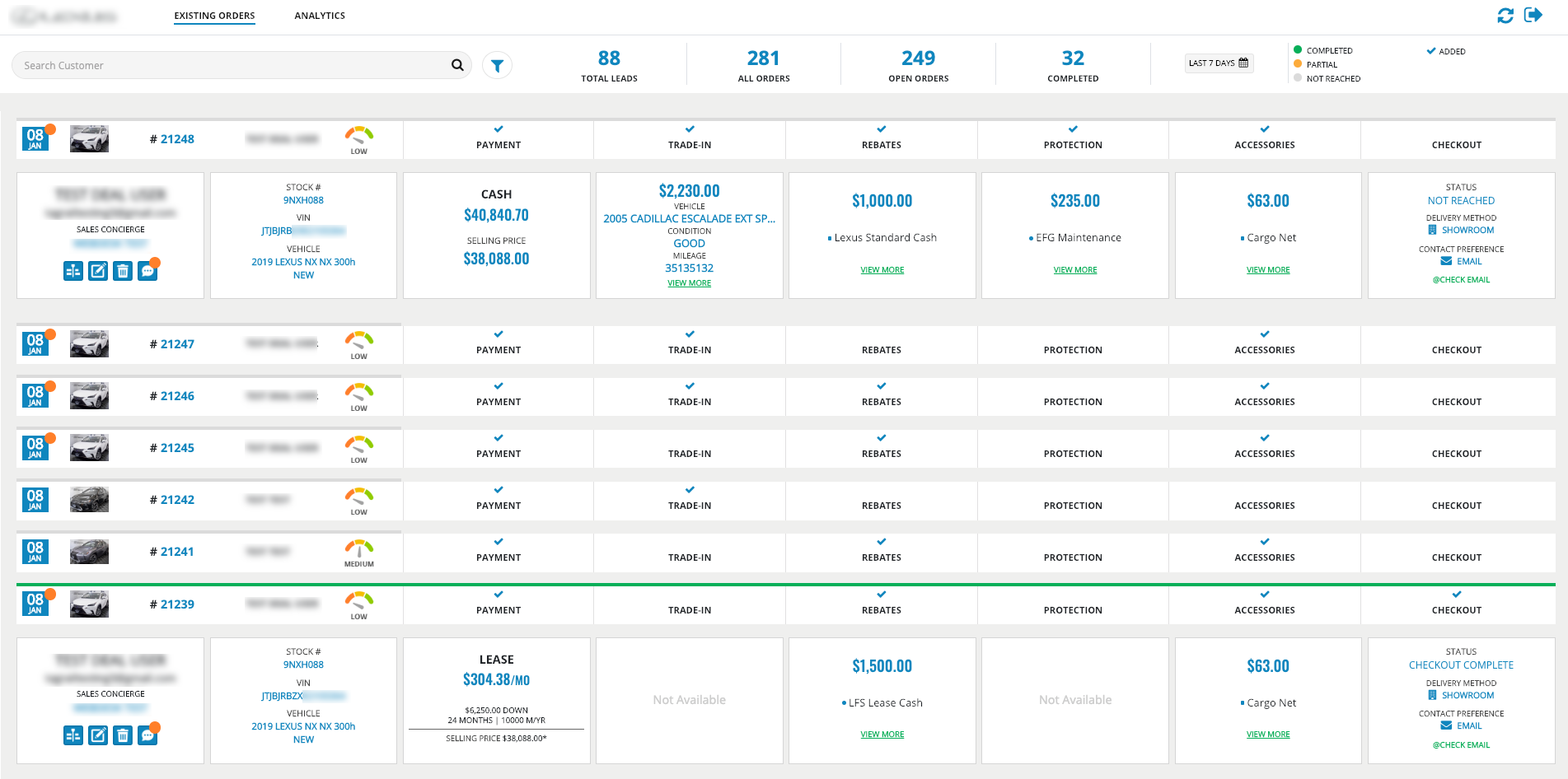

Let us look at what dealership side experience looked like for this customer.

- As soon as the customer was on the website, we sent a notification about the prospect and it is visible in the DR dashboard.

- As soon as the prospect converted into an opportunity, the CRM was notified with the lead details. If the lead abandoned half way through the process the CRM response rules would have kicked in.

- The customer pre-purchase attribution was pushed to the CRM along with the lead and it tells the entire path the customer took while online. This is also available to pull up in the dashboard.

- If the dealership decides to enable the soft pull they also have an option to set the tool to show penny perfect payments based on a credit score.

- The customer can be contacted via a secure messaging to confirm the details and the appointment can be scheduled.

- A quote can be generated from the dashboard in case of an abandoned lead.

- The BDC or internet department can securely request any additional documentation that the customer can upload before coming to the dealership.

Let us look at what the delivery experience looked like for this customer.

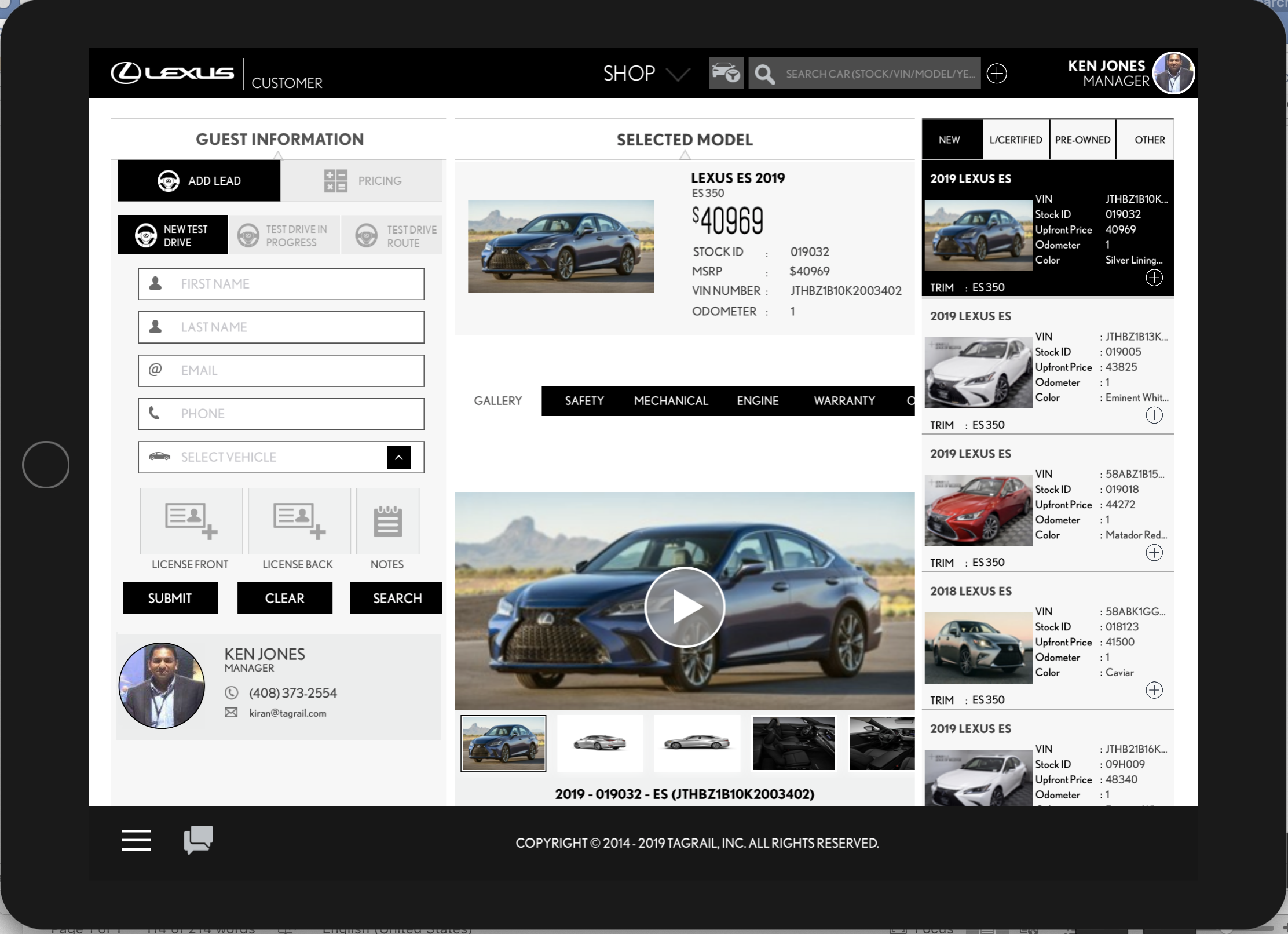

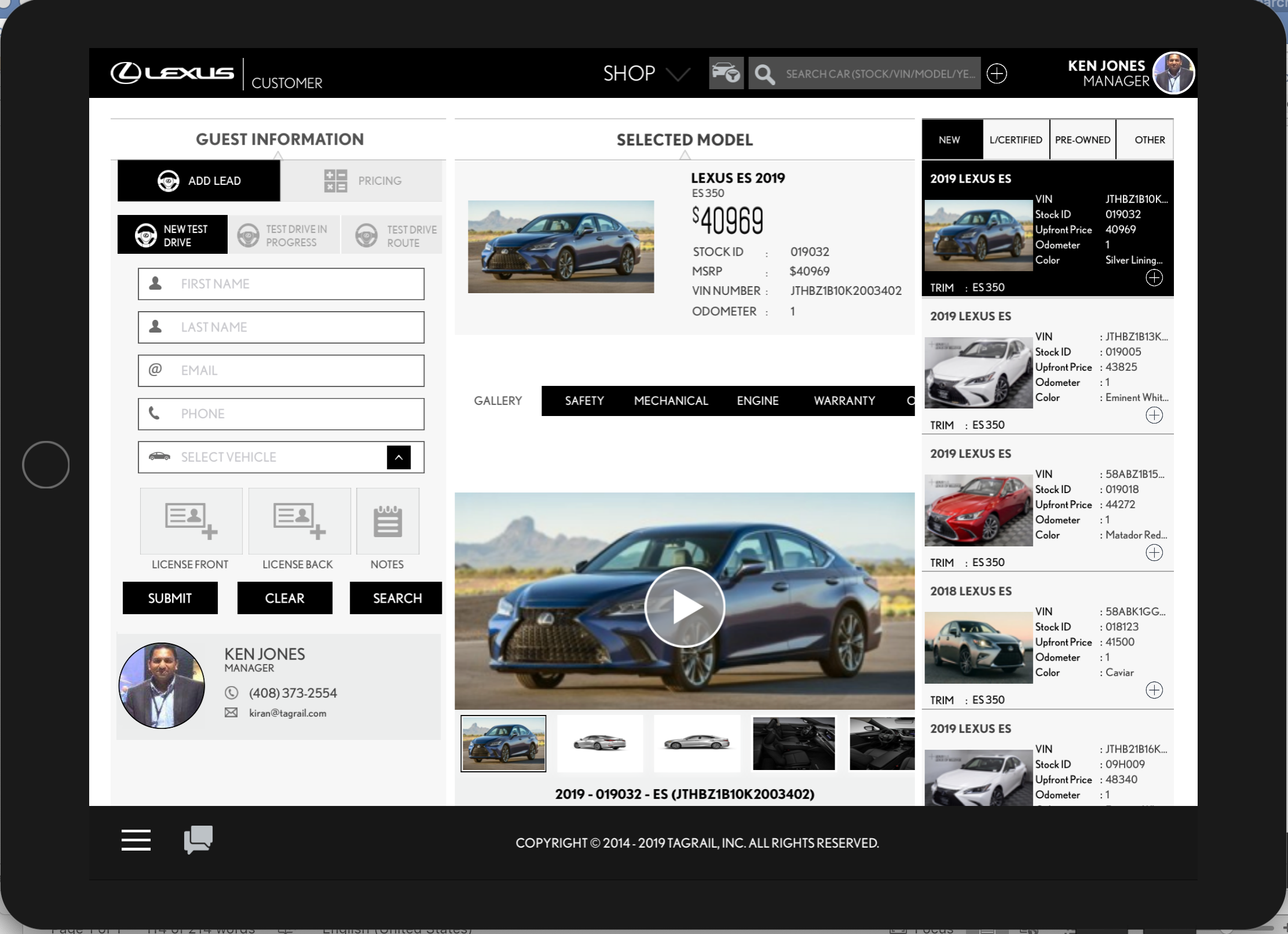

In Store Digital Retailing App

- Customer received a text notification with a QR code once the appointment was set.

- When the customer arrived, the receptionist scanned the code and the assigned sales consultant got a notification. Clicking on the notification brought up the customer record with the full deal jacket already loaded up on the tablet.

- The sales consultant verified specific details using the tablet application, did a vehicle walk through with the customer, appraised the trade , did the demo drive and got the vehicle ready for delivery.

- The customer completed the credit application before coming to the dealership and in this case it was pushed to their RouteOne eContracting system.

- The F&I manager greeted the customer and discussed the protection options that was selected and completed the paperwork with the customer.

- The entire in store experience lasted less than an hour.

What I described above is not an urban legend, this is what our progressive customers are doing every day using our platform. This also explains the reason why our dealers are seeing a conversion rate of 7–8% on an online lead versus a typical lead form conversion for 1–2%. The path to purchase and the purchase itself has to be seamless and frictionless.

Now wouldn’t this be the ABCs of “Digital Retailing” that all of us in this space need to follow. Let DR not be treated like another “Lead Generation” tool.

We are happy to have our platform set the bar high and make the omnichannel transaction experience a memorable one for our customers.

For more details please visit us http://www.tagrail.com/